State regulators, electric power industry experts, and policy advocates gathered at Northwestern’s Pritzker School of Law on April 25 for the Searle Center on Law, Regulation, and Economic Growth Third Annual Electricity Dialogue Conference. Following the robust discussion of current industry trends, one fact remained clear: the ways we produce, transport, and consume electricity in the Midwest are undergoing a radical transformation, and no one knows exactly what the future has in store.

“This is big. It’s a revolution,” remarked conference attendee Erin O’Connell-Diaz, a former utility company regulator at the Illinois Commerce Commission. Most conference participants shared her feelings of excitement and apprehension.

Historically, the electric power industry has been slow when it comes to embracing change. Thomas Edison would easily recognize today’s electric grid because the basic architecture has evolved so little since he invented the lightbulb in 1879. But the power sector is under tremendous pressure to embrace change and innovation like never before. This pressure is coming from the convergence of several factors including pending environmental regulations, emerging “smart grid” technologies, low natural gas prices, and growing demand for renewable energy and battery storage.

Uncertain Environmental Regulations

In February 2016, the U.S. Supreme Court temporarily halted implementation of the Clean Power Plan, a fundamental component of the Obama Administration’s attempts to reduce carbon dioxide emissions in the United States. The Clean Power Plan requires states to cut emissions from electric power plants by one third below 2005 levels by 2030 and involves a substantial overhaul of the power sector. However, until the Court issues a final ruling, the decision to temporarily halt implementation prevents the Environmental Protection Agency from enforcing a September deadline for states to submit their emissions reduction compliance plans to the federal government.

Given that many states have been planning for implementation of the Clean Power Plan as far back as June 2014 when the draft regulation was first proposed, the fact that the Supreme Court may now decide to block the initiative created uneasiness among conference attendees. Public policy advocates from Michigan and Illinois stressed that both states have halted their ambitious planning processes until they receive a definitive ruling from the Court. On the other hand, Minnesota is moving ahead with its plan to meet its emissions reduction targets. “We’re one of the few states in the Midwest that are open about our plans to move forward on this,” explained David Thornton of the Minnesota Pollution Control Agency. “Our citizens want us to create clean jobs, especially in low-income communities... They want environmental justice. They want affordable electricity. They want [policy makers] to be cognizant of any jobs that may be in jeopardy if coal power plants close,” he said.

In addition to pushing for a massive overhaul of the power sector, if upheld by the Supreme Court the Clean Power Plan would strongly incentivize states to form regional carbon dioxide trading markets. Gerald Keenan, chairman of the Illinois Pollution Control Board and panelist at the conference, pointed out the benefits of initiating this conversation among the states: “The sulfur dioxide trading system is a national program, and look how much we’ve learned from that. The Clean Power Plan has started a similar conversation about [how to form] a carbon dioxide trading system,” he said, referring to the sulfur dioxide cap-and-trade regime George H.W. Bush signed into law in 1990.

“The Clean Power Plan has also encouraged economic and environmental regulators to talk to each other,” which is essential and surprisingly rare, added Mar Reguant, Assistant Professor in Northwestern’s Department of Economics and Electricity Dialogue panelist. Despite the uncertainty surrounding the future of the regulation, many conference attendees agreed that the Clean Power Plan has done much to spur a national conversation about the intersection of climate and energy policy in the United States.

Takeover of Smart Grid Technology

This year marks the 20th anniversary of The Telecommunications Act—a law that helped modernize our country’s communication grid and usher in an era of smart phones and the Internet. In many ways, the smart grid is facilitating a similar transformation of the electric grid. The smart grid, which is being installed across the country, will turn today’s opaque and antiquated electric grid into a complex communication network in which home appliances can “talk” to each other, to smart phones, and to electricity markets in real-time in order to more efficiently manage the way they use power. It will help facilitate integration of electric vehicles, “smart homes,” and new kinds of power production including renewables. It will also allow operators to manage the grid remotely giving them the ability to read meters, identify power outages, and easily reroute electricity from a central location.

“The smart grid is not just [electric] meters. It’s about a vast communication network that sits on top of the electric grid,” explained Lynne Kiesling, conference panelist and Associate Professor in Northwestern’s Department of Economics. She described how the smart grid allows users to automate devices to use electricity more efficiently, leading to lower prices for consumers and reduced carbon emissions from power plants. "The smart grid allows you to connect and program [devices]. And, from an economic perspective, it also reduces transaction costs.”

In March, Commonwealth Edison (ComEd) announced that it achieved 2 million smart meter installations, halfway towards its goal of deployment in all homes and businesses across its northern Illinois service territory by 2018. Although the industry is rapidly deploying smart meters throughout the country, the movement is still in its infancy. “We’re still exploring ways to maximize the value of the data generated by smart meters,” explained Thomas O’Neill of ComEd.

Diane Munns of the Environmental Defense Fund’s Clean Energy Program remained optimistic about the potential for smart grid development: “Broadband Internet technology was pushed by the endgame. It was pushed by people using programs like Napster. People wanted music and broadband was the best way to get it. For the smart grid, we don’t yet know what this endgame will be.”

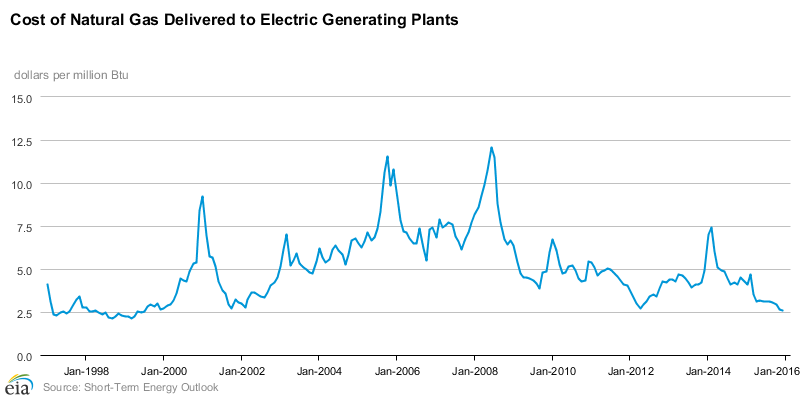

Low Natural Gas Prices

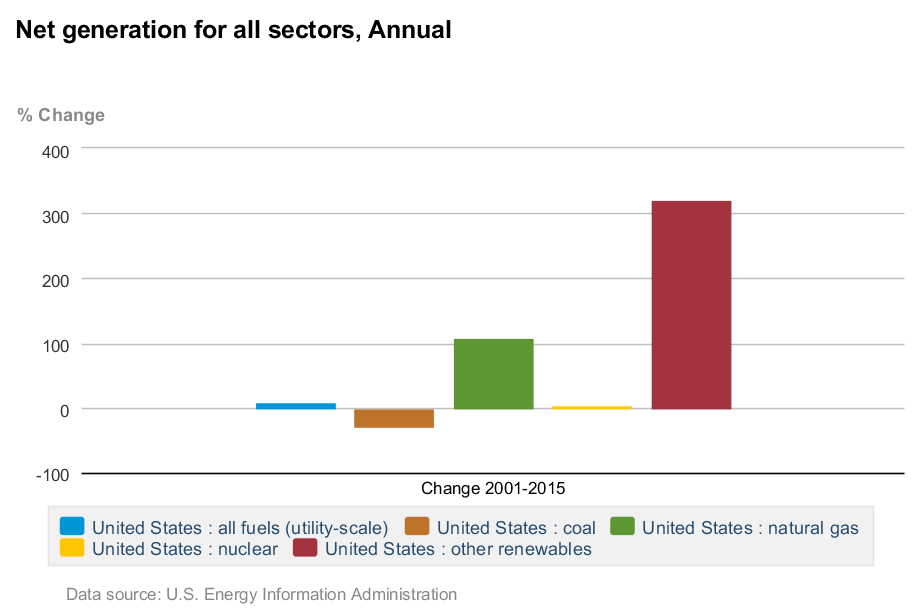

Historically, the majority of electricity generation in the United States has come from coal-fired power plants. However, according to the U.S. Energy Information Administration, as of 2015, consumption of coal used for electricity generation in the country’s electric power sector fell 29 percent from its peak in 2007 due in large part to the low price of natural gas. As natural gas outpaces coal and continues to become more economically competitive, power generators begin using gas instead of coal to produce electricity. In addition to being cheaper, using natural gas instead of coal for power production leads to 50 to 60 percent fewer carbon dioxide emissions according to the National Energy Technology Laboratory.

“We’re in a period of tremendous change these days, and the power plant fuel mix is near the top of the list in terms of the changes we’re seeing,” explained Stu Bresler of PJM, the wholesale electricity market and transmission grid operator that stretches from New Jersey to northern Illinois and serves more than 61 million consumers. This is the first year since PJM’s founding in 1956 that the quantity of natural gas exceeded coal in PJM’s territory, and the shift shows no signs of slowing down. “It’s becoming extremely significant,” Bresler commented.

The effects of the fuel shift are evident in Northwestern’s home state of Illinois as cheap natural gas flows from places like Ohio and Pennsylvania. A notable amount of the coal power plants downstate are rapidly aging and are no longer able to compete with gas, explained Gerald Keenan of the Illinois Pollution Control Board. “Most of these plants will probably retire in the next 12 to 24 months,” he said, implying that many will likely be replaced with cheaper, more efficient natural gas generation.

Growth of Renewable Energy and Battery Storage

Sharply higher demand for renewable energy over the last several years has been driven by environmental awareness among consumers, public policy initiatives, declining costs of production, and more efficient technologies. Despite the growing demand, most renewable energy sources still face the problem of intermittency. As Stu Bresler of PJM explained at the conference: “There are tracking systems that are well developed and are being installed for solar panels that increase their [efficiency] from 38 to 60 percent or greater. The problem is that during a winter… day when the sun isn’t up yet, how much can you really count on them?”

This reality highlights the importance of improved and emerging battery technology. Batteries can store solar and wind energy when they are at their highest levels of production and make that energy available when needed. Sally Talberg, Chairman of the Michigan Public Service Commission, noted the important convergence of renewable energy and battery storage: “In 2015, 3,400 megawatts of solar energy were added in the United States, which is a 37 percent increase from the previous year. 221 megawatts of [battery] storage were installed in 2015, which is a 243 percent increase from 2014.”

Batteries are also becoming more prevalent due to their declining price. “One study suggests storage will cost about one third less in 2017 than it did in 2015,” Talberg noted, referencing a 2016 U.S. Energy Storage Monitor report. The falling price is fueled mostly by improvements in production materials and methods.

Looking Ahead

Uncertainty associated with environmental policies, rapid expansion of smart grid technologies, low natural gas prices, and growing demand for renewable energy and battery storage are forcing the electric power sector into uncharted territory. “We’ve got a lot of head-scratching to do when we think about what reliability will look like in the future,” reflected Clair Moeller of MISO, the wholesale electricity market and transmission grid operator that covers most of the upper Midwest and parts of the Southeast. “We need to think about what the future looks like and not get married to trying to make the future look like the past.”

***

The Searle Center on Law, Regulation, and Economic Growth Third Annual Electricity Dialogue Conference was sponsored by Advanced Energy Economy Institute, Edison Electric Institute, PJM Interconnection, and MISO.

Photo Credit: Nuala, Flickr