If electronics are the underpinning of our modern economy, then batteries are what make the world go round. And since its commercial introduction in 1995, the lithium-ion (li-ion) battery has been king.

Over the past 30 years, a three-fold improvement in energy density has driven li-ion batteries far down the cost curve, from more than $3,000/kWh to approximately $150/kWh today, making li-ion the battery chemistry of choice for our toys, consumer electronics, medical devices, power tools, and increasingly, cars. Applications for household and grid storage that balance the intermittency of renewables are already hitting the market. Indeed, the $30 billion industry is expected to clock a blistering 11.6% annual growth rate through 2024, to a valuation of nearly $80 billion1.

The grass isn't always greener

This technical and economic progress belies a more disturbing trend. Battery startups are failing - spectacularly. High upfront capital requirements, long R&D timelines, low margins, and few opportunities for technical de-risking make the battery industry a tough business. Since 2000, of 36 companies that have raised more than $500,000, fewer than half ever achieved pilot manufacturing or a key corporate partnership, and only two have had positive exits (paying back at least invested capital). Missteps among some of the highest prospective flyers – A123, Ambri, Envia, Leyden Systems – include excessive capital raises, a go-to-market strategy immediately attacking a large-scale market, and an excessive appetite for R&D spending. In all, of $764 million invested between 2004-2014, only $123 million has been returned. This staggering 84% loss rate has, perhaps predictably, resulted in funding retrenchment, wherein materials/chemical/process startups were less than 30% of all venture capital (VC) cleantech investment in 2014.

"Our research shows that VCs lost a lot of money investing in cleantech hardware like batteries and new solar over the last 10 years,” says Ben Gaddy, Director of Technology Development at Clean Energy Trust, a Chicago-based cleantech accelerator. "Funding for early-stage companies has been hit hardest. The reality is that the capital landscape is completely different now. The next generation of battery startups aren't going to be able to raise hundreds of millions of dollars before shipping their first product, so they're going to need to think about staying lean."

A better battery business

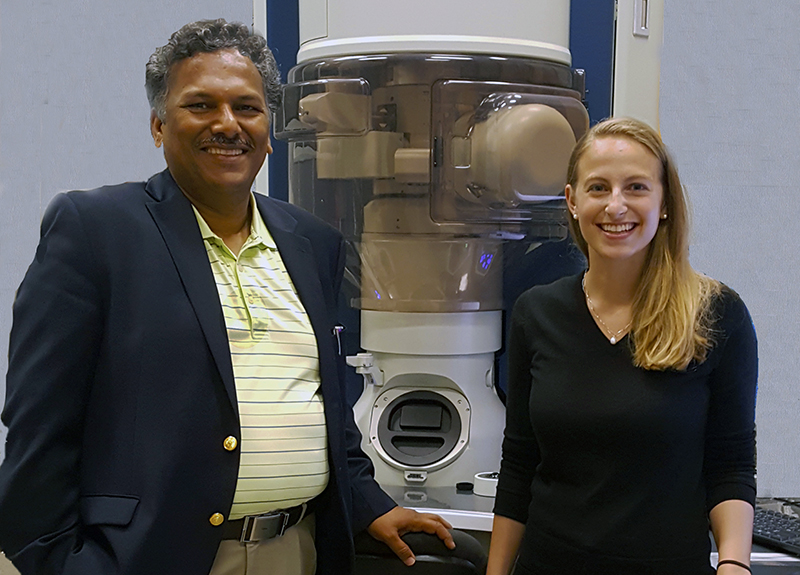

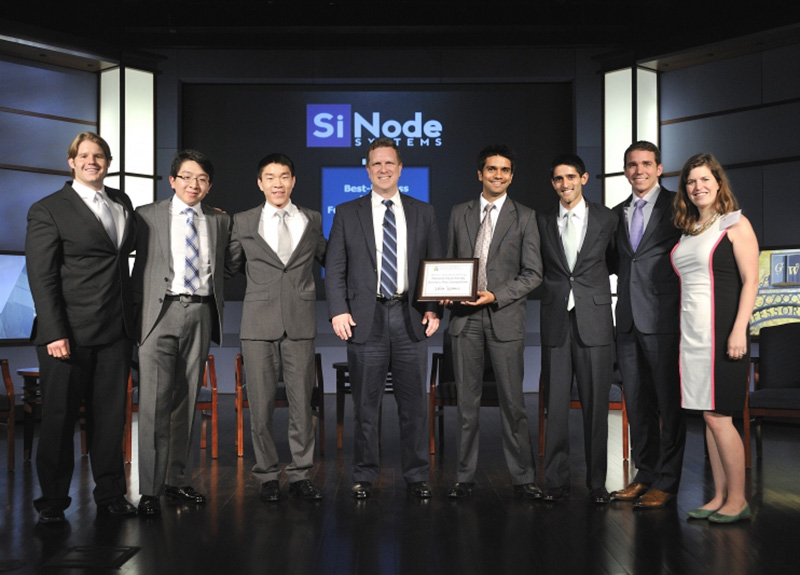

There’s a better way to do this, according to one of those 36 companies. In a paper released this week by MRS Energy and Sustainability, Samir Mayekar (KSM ’13, CEO of SiNode Systems, an early-stage Northwestern advanced battery materials spinout, and University trustee), along with Northwestern materials science and engineering co-authors Professor Vinayak Dravid and doctoral candidate Eve Hanson (first author), argue that the venture capital model is inherently mismatched for the battery startup model, and that companies would be better served borrowing commercialization lessons from the pharma industry.

The paper, "Applying Insights from the Pharma Innovation Model to Battery Commercialization – Pros, Cons, and Pitfalls," highlights three critical recommendations for battery entrepreneurs:

- First, focus on customer-led performance metrics. Measures of academic merit are not necessarily the same as commercial performance benchmarks, and cell and battery assemblers are unlikely to spend on new innovation that can’t measure up with existing technology. Joint development agreements, common in pharma, are an excellent mechanism to acquire rapid feedback from potential early customers.

- Second, carefully consider a proposed early market. Attack high-margin, niche opportunities first as a mechanism to acquire customer feedback and early revenue, particularly if the technology has unique performance capabilities that are well suited to a particular application. Multi-billion dollar markets like automotive and grid storage are bad first targets, as competitiveness in a commoditized market relies on very expensive manufacturing scale. In pharma, drugs that successfully target under/unserved markets can turn into blockbusters.

- Finally, fundraise strategically. Take advantage of non-dilutive capital like federal grants, get joint development partners to help pay for R&D, and if raising VC, don’t overcapitalize. While the FDA clinical trial process helps signpost key development milestones, and typically correlates with the value of pharma innovation, battery companies don’t benefit from similar validation transparency. Battery exits have historically been IP-driven for less than $10 million, or manufacturing/asset-driven from more than $50 million. Pre-manufacturing capitalization of more than $10 million carries risk of investors not being made whole.

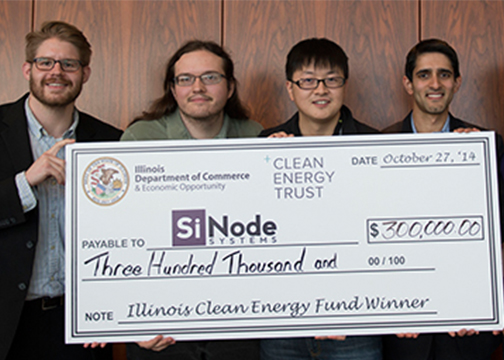

SiNode has carefully followed this roadmap in its development of its silicon anode since 2013. It has only raised a seed financing round, relying heavily on a lean capital model. It has also developed pilot customers across the battery landscape (including niche markets and longer-term scale-up targets), from materials companies, to cell and pack manufacturers, all the way up to OEMs. Resulting recommendations for other relationships have made it easier for SiNode to integrate into the battery manufacturing supply chain, de-risking its technical development pathway. "Nothing is easy in this industry,” says Mayekar. “You’ve got to take a patient, long-term view of your product roadmap, and be prudent with your go-to-market strategy. It takes a village to develop a new materials technology, and an appropriate burn-rate, world class partners, and the right market focus can help lighten that load immensely."

The authors also include complementary recommendations for VCs, component, cell assembly, and equipment manufacturers, and policy makers, designed to create a more effective and efficient battery startup ecosystem.

"High-performance battery technology is critical, but without supporting business model innovation that technology may never see the light of day." says Hanson. "We hope these recommendations help transformative battery technologies become viable businesses."

Research was funded by the National Science Foundation under Grant no. DMR-1507810, and by the U.S. Department of Energy, Office of Science, Office of Basic Energy Sciences, under Award Number DE-SC0014520. Research also supported as part of the Center for Electrochemical Energy Science, an Energy Frontier Research Center funded by the U.S. Department of Energy (DOE), Office of Science, Basic Energy Sciences (BES), under Award # DEAC02-06CH11357 (for paper conception).

For the full paper, please see: http://ow.ly/D8rw30eWUNN